Simplifying the mortgage process

Let us guide you through the process of finding a mortgage that meets your unique needs.

Mortgage financing can be confusing, it doesn't have to be, here's the plan.

Get started right away

The best place to start is to connect with us directly. The mortgage process is personal. Our commitment is to listen to all your needs, assess your financial situation, and provide you with a clear plan forward.

Get a clear plan

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming. Let us cut through the noise, we'll outline the best mortgage products available, with your needs in mind.

Let us handle the details

When it comes time to arranging your mortgage, we have the experience to bring it together. We'll make sure you know exactly where you stand at all times. No surprises. We've got you covered.

Lee Welbanks

Principal Broker/Owner

Lee is a professional and passionate champion for his customers. People who meet him soon understand the many benefits of making their all-important mortgage decisions through an accredited mortgage broker who is working for them.

After four years of full-time study, Lee graduated the University of Toronto in 1995 with a Bachelor of Business Administration (BBA), Specialty in Finance. He immediately began mortgage lending in Toronto for a major Canadian financial institution where he acquired the depth of financial planning knowledge to step out on his own.

Lee’s customer service is ongoing; after the closing the transaction he looks out for his customers, ensuring they continue to leverage marketplace intelligence, the changing regulatory environment and smart financing strategies to reduce debt and save interest. As a Reverse Mortgage specialist, he guides Canadian homeowners who are planning for retirement through this unique solution of

accessing the equity in their home as a financial planning strategy.

And if passion, perspective and motivation aren’t enough, Lee is a member in excellent standing of Mortgage Professionals Canada.

Lee Contact Lee any time to arrange a confidential mortgage discussion and review your financing options.

Here are some nice things clients have said about working with us.

Looking to run some numbers?

Mortgage Calculator

A simplified and easy to use mortgage payment calculator, for purchase renewal, or refinance.

Whatever your needs, I have the home financing solutions for you.

Mortgage financing for Older Canadians in Retirement.

- Providing opportunities so you can enjoy your life and benefit those you love.

- Reverse Mortgages - everything you need to know to access the equity in your home as a financial planning strategy.

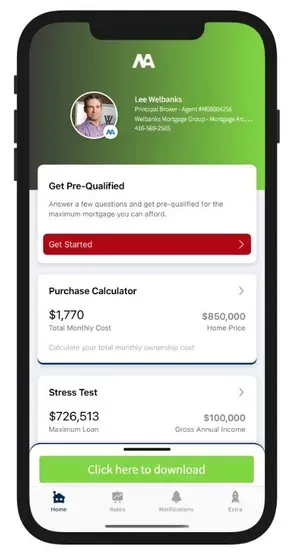

Download My Mobile App

WHAT CAN YOU DO WITH MY APP

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Go ahead and schedule a meeting with me!

Articles to keep you learning